What is an asset\'s useful life?

تعداد بازديد : 2206

What is an asset's useful life?

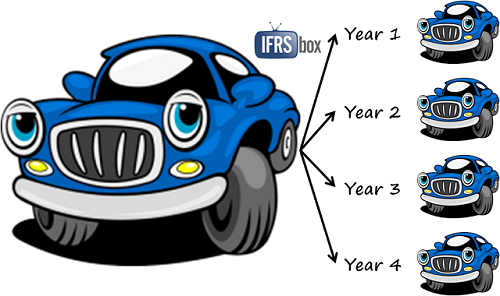

An asset's useful life is the period of time (or total amount of activity) for which the asset will be economically feasible for use in a business. In other words, it is the period of time that the business asset will be in service and used to earn revenues.

Because of the advances in technology, an asset's useful life is often less than its physical life. For example, a computer may be useful for only three years even though it could physically be operated for decades.

The useful life (as well as the salvage value at the end of the useful life) are estimated amounts needed in the calculation of the asset's depreciation. Depreciation is required so that the company's financial statements comply with the matching principle.

In the U.S., income tax regulations specify the useful life that must be used for income tax reporting. This is one reason that in a given year the depreciation on a company's income tax return will not agree with the depreciation reported on its financial statements.